Car sales (& LQ45) still in a down trend for now

Close correlation between cars & LQ45 is in recovery from 2Q low, but still trending down.

July 12, 2024

A simple analysis

June cars up a bit

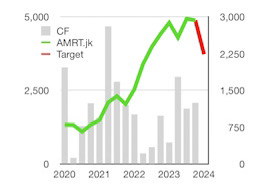

Indonesian car sales data just released shows a slight improvement in June, up about 2% from May to about 72,000 units. But this is still lower than a year ago.

Seasonally lower 2Q to rebound

The second quarter was seasonally lower than the first quarter because of the long holiday. But extrapolating June forwards (last bar in the chart below), third quarter sales will be higher, as they normally are seasonally.

LQ45 follows closely

Car sales has historically had a good coincident correlation with the LQ45 stocks index. Stocks followed the weaker second quarter but have recovered anticipating a better third quarter. To keep the correlation, stocks could still rise a bitl more as the chart shows.

But still down trend

But the caveat is that car sales are still in a down trend for now. We would need to see a break of this trend in the next few months to say that the stock market can rise more significantly.

LT down trend too

Longer term car sales peaked in 2012 at about 1.2 million units for the year. The last twelve months up to June is still well below that level at just over 900,000.

Sharpfokus Team

+6287855572666

Close correlation between cars & LQ45 is in recovery from 2Q low, but still trending down.

July 12, 2024

A simple analysis

June cars up a bit

Indonesian car sales data just released shows a slight improvement in June, up about 2% from May to about 72,000 units. But this is still lower than a year ago.

Seasonally lower 2Q to rebound

The second quarter was seasonally lower than the first quarter because of the long holiday. But extrapolating June forwards (last bar in the chart below), third quarter sales will be higher, as they normally are seasonally.

LQ45 follows closely

Car sales has historically had a good coincident correlation with the LQ45 stocks index. Stocks followed the weaker second quarter but have recovered anticipating a better third quarter. To keep the correlation, stocks could still rise a bitl more as the chart shows.

But still down trend

But the caveat is that car sales are still in a down trend for now. We would need to see a break of this trend in the next few months to say that the stock market can rise more significantly.

LT down trend too

Longer term car sales peaked in 2012 at about 1.2 million units for the year. The last twelve months up to June is still well below that level at just over 900,000.

Sharpfokus Team

+6287855572666