HMSP.JK 33% upside BUY. Sales rising faster, profitability recovering

Apr 26, 2024 ; a simple analysis of the first quarter results

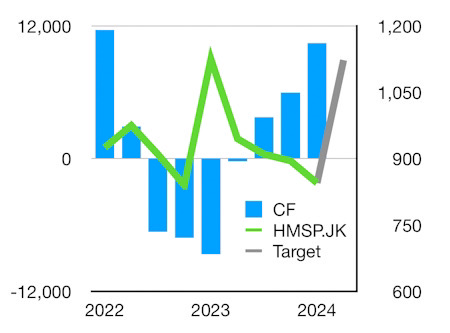

1 Sales of 29,107 billion rupiah was + 8% from a year ago vs +3% the previous quarter.

2 Quarterly free Cashflow CF was 2,425 billion rupiah vs -796 billion rupiah the previous quarter & -2,051 billion rupiah a year ago.

3 Twelve months CF was 10,430 billion rupiah up from -8,642 billion rupiah in the previous twelve months.

4 The CF return on assets of 55,800 billion rupiah was 6% for six months. 19% for twelve months & an average 17% for the last seven years.

5 Using a risk free rate 6% divided into the average of the six, twelve months & seven years CF return 14% gives a target valuation 234% for market cap / assets .

6 The current valuation of market cap / assets 176% is lower.

7 Thus there is 33% upside for the share price to 1,123 rupiah. BUY.

Sharpfokus Team

+6287855572666

Apr 26, 2024 ; a simple analysis of the first quarter results

1 Sales of 29,107 billion rupiah was + 8% from a year ago vs +3% the previous quarter.

2 Quarterly free Cashflow CF was 2,425 billion rupiah vs -796 billion rupiah the previous quarter & -2,051 billion rupiah a year ago.

3 Twelve months CF was 10,430 billion rupiah up from -8,642 billion rupiah in the previous twelve months.

4 The CF return on assets of 55,800 billion rupiah was 6% for six months. 19% for twelve months & an average 17% for the last seven years.

5 Using a risk free rate 6% divided into the average of the six, twelve months & seven years CF return 14% gives a target valuation 234% for market cap / assets .

6 The current valuation of market cap / assets 176% is lower.

7 Thus there is 33% upside for the share price to 1,123 rupiah. BUY.

Sharpfokus Team

+6287855572666