UNVR.jk -3% downside SELL. Negative cashflow in the first quarter

Apr 24, 2024 ; a simple analysis of the first quarter results

1 Sales of 10,080 billion rupiah was -5% from a year ago.

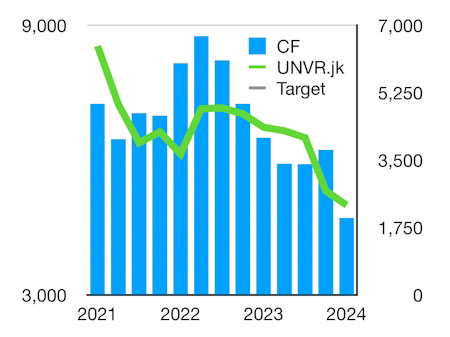

2 Quarterly free Cashflow CF was -591 billion rupiah from 1,701 billion rupiah the previous quarter & 924 billion rupiah a year ago.

3 Twelve months CF was down to 4,710 billion rupiah vs 6,499 billion rupiah in the previous twelve months.

4 The CF return on assets of 18,342 billion rupiah was down to 12% for six months. 28% for twelve months vs a 35% average for the last seven years.

5 Using a risk free rate 6% divided into the twelve months return 28% gives a target valuation of 471% for market cap / assets.

6 The current valuation market cap / assets 485% is higher.

7 Thus there is still -3% downside for the share price to 2,265 rupiah. SELL.

Sharpfokus Team

+6287855572666

Apr 24, 2024 ; a simple analysis of the first quarter results

1 Sales of 10,080 billion rupiah was -5% from a year ago.

2 Quarterly free Cashflow CF was -591 billion rupiah from 1,701 billion rupiah the previous quarter & 924 billion rupiah a year ago.

3 Twelve months CF was down to 4,710 billion rupiah vs 6,499 billion rupiah in the previous twelve months.

4 The CF return on assets of 18,342 billion rupiah was down to 12% for six months. 28% for twelve months vs a 35% average for the last seven years.

5 Using a risk free rate 6% divided into the twelve months return 28% gives a target valuation of 471% for market cap / assets.

6 The current valuation market cap / assets 485% is higher.

7 Thus there is still -3% downside for the share price to 2,265 rupiah. SELL.

Sharpfokus Team

+6287855572666